eChecks can assist your industry to collect payments without delay

Are you thinking to gather eCheck payments from clienteles? Want to get electronic check processes for your business? Well, need not to worry as there are several financial firms that can offer you secure service related to eCheck processing. Secure data make your information secure with eCheck processes and offers speedy growth to the businesses.Look for eCheck processes for expanding your business and gain profits!

Electronic Check security to your business without worry!

By eChech processes, you can easily secure your business, a payment done online where cash is electronically withdrawn from the bank account of payer’s. This type of payment process is done through the ACH network and transferred to another account.

How does the eCheck processing works?

Electronic check processing is similar to paper checks that generally people perform when transferring money to somebody’s account or the business they need to pay. Today, we can observe the technology is too speedy and the people can easily pay the sum by means of eCheck processing. This not only saves your time but also aids in checking paper waste.

Procedures needed for eCheck processing

- Request for approval –If you want an eCheck processes for your business then the business must gain its approval from the client in order to make the payment. This can be processed through an online form that one has to fill it and sign it or process it through telephonic conversation.

- Payment set Up- After approval is completed; the business adds payment details while processing online. If it is repeated payment procedure then this info will also consist of info of the repeated agenda.

- Make it approved and submits – When the payment info is properly accepted by the software, the industry moves further by clicking submit and begins with ACH transaction.

- Payment is confirmed and deposited – The sum is automatically withdrawn from the payee’s account and the online software works as an effective tool by sending a payment receipt to the client. This makes it easy for the business as the sum is deposited by the payee into the business account and the duration takes 3-5 days after the ACH transaction is done.

How one can avail eCheck processing for their business?

Signing up for an eCheck is similar to getting a credit card merchant account. Once an industry found a best-fit merchant account supplier, the business will require offering facts including:

- Number of years in business

- Federal Tax Identification

- The projected processing capacities

The whole procedure takes place within a few days and thus it is quite helpful for the customers and the businesses as it makes your payment processes in an easy manner.

Secure payment data offered through eCheck processes

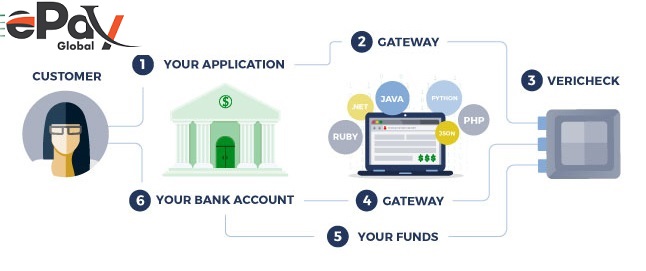

All checks are processed with the help of merchant account provider eCheck Payment Gateway solutions for your business. This aids to protect your data in a fine manner. There is no data revelation and your facts are kept protect with eCheck processed software.

Extend your international business with electronic check payments!

If you want to expand your business at an international level then eCheck processing solutions work well. You can receive your payment in time as it is the quickest way to obtain payments for your business by means of electronic checks. This system is suitable for the businesses as it is economical as compared to other alternatives such as credit card, debit card, wallets and various more. The payment gateway processes provided by the Collection Agency Merchant Account providers to the businesses in the form of electronic checks are quite secure and makes your business excel. Want a speedy business; get the best eCheck processes online!